Insights

Legalign Global™ regular Jon Meer, partner at Wilson Elser New York will present the second in his series of webinars on the duties of Directors and Officers (D&Os) on March 12, 2024, 1 – 2pm ET.

“Rise of Ransomware and Other Cyber Risks Impacting D&O Coverage”. addresses issues insurance adjusters and underwriters are facing when writing D&O policies and adjusting claims related to D&O exposure on cyber issues such as ransomware.

Jonathan and his co-presenter, Larry Goanos, Executive Vice President of the professional lines practice at Amwins, will provide an understanding of the exposures of D&Os when there are such breaches and the resulting litigation and/or government investigation.

Follow the link to sign up – https://bit.ly/4bQ6Dy6

To celebrate our 20th anniversary, Wotton + Kearney is committing to making ‘20 Actions for 20 Years’ that will make the firm a better and more responsible business. The 20 Actions for 20 Years Project promises to create a lasting legacy for the firm in the areas that its people think are most important today – reduced inequality, climate action, mental health and wellness, and social justice.

To identify our areas of focus, we undertook a consultative process using the framework of the United Nations Sustainable Development Goals of Gender Equality, Reduced Inequalities, Climate Action, and Peace, Justice and Strong Institutions.

“Once we agreed our priorities, we deliberately chose to start work on just a few short-term actions as the project is designed to evolve over a 20-year period. Our first three actions are aimed at getting our own house in order before we move on to external actions,” said David Kearney, Wotton + Kearney’s Chief Executive Partner.

The first three actions involve:

- reducing inequality and going public with the commitment – this will include signing up to the Equitable Briefing Policy and the Charter for the Advancement of Women, publishing gender-based leadership targets and agreeing a Reconciliation Action Plan,

- reducing climate impact and going public with the commitment – this will include signing up to Climate Active and publishing emissions targets, and

- auditing current activities across all four areas of focus to create a baseline from which to measure the impact of the 20 activities.

David Kearney added: “Understanding where we are now and ‘going public’ with our intentions are important because we want to be held accountable for our role in fostering equality, reducing climate impact, and improving wellbeing and social justice over time. That means we need to be able to factually report on our progress – to our people, to our clients, to industry bodies and to the communities we operate within.”

Contribution to community is a way of life at Wotton + Kearney. Over the coming years many of the 20 Actions will likely form part of the firm’s pro bono and responsible business program – Community Footprint. More information about Wotton + Kearney’s commitment to achieving positive change and sustainable growth, and being a responsible business, can be viewed in the video below.

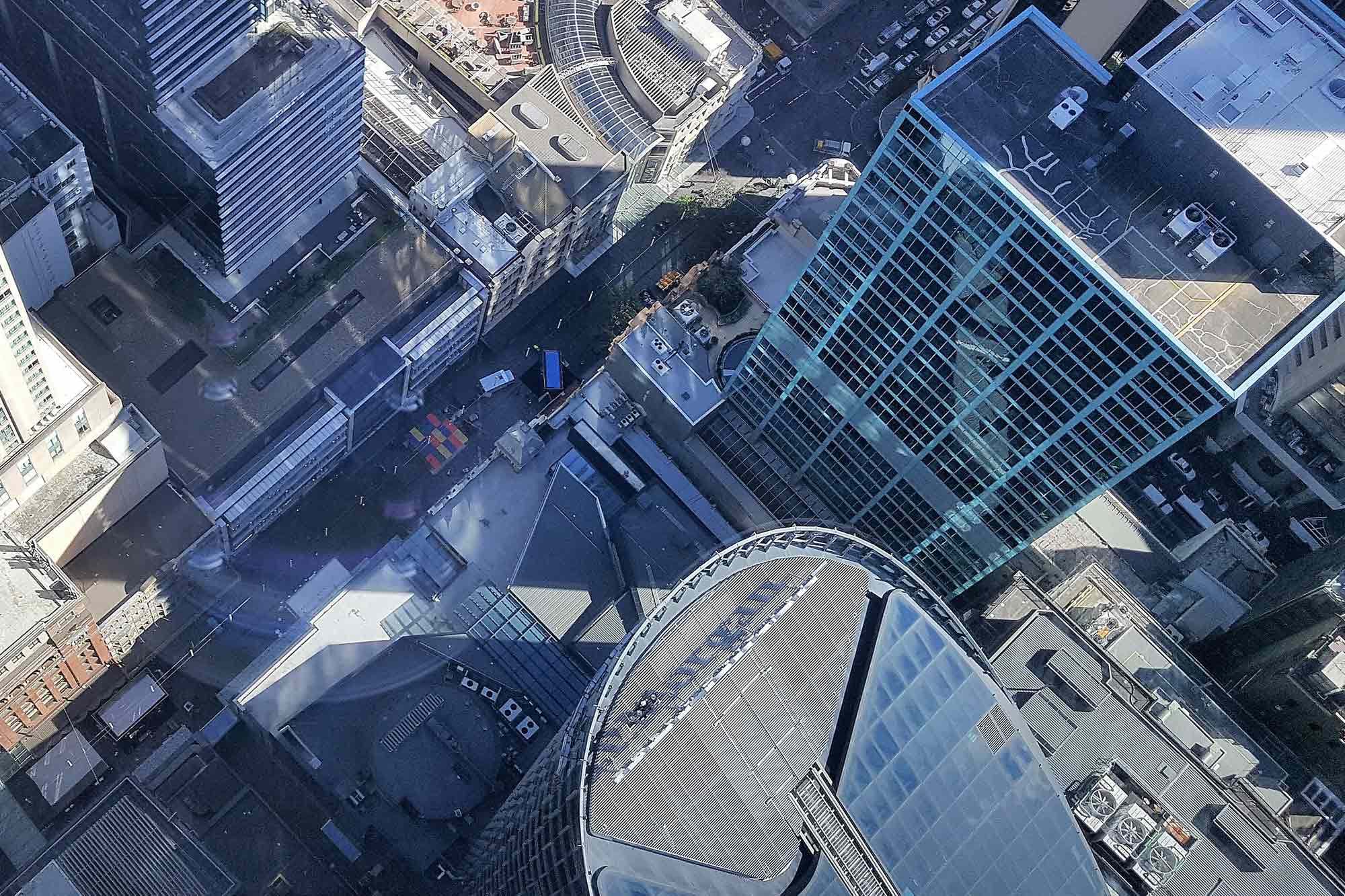

Legalign Global alliance member, Wotton + Kearney, has opened a new office in Adelaide, Australia. This move continues the firm’s growth trajectory and expanding its footprint into seven cities across Australia and New Zealand – and further expands our global coverage.

David Kearney, Wotton + Kearney’s Chief Executive Partner, said: “Our expansion into Adelaide will meet our increasing local client demand. It’s also a great example of our People First strategy in practice. Throughout the pandemic, we had lawyers who understandably wanted to work from home in their home town. That worked so well that we have now opened an office for the team.”

The firm’s move into Adelaide is the latest chapter in its growth story. It follows recent senior appointments across its Property, Energy & Construction, Financial Lines and General Liability practices and in the specialty lines of Cyber, Marine & Transport and Health, as well as the arrival of the former DLA insurance team in New Zealand.

Wotton + Kearney now has more than 330 dedicated insurance lawyers, including 58 partners, across Sydney, Melbourne, Brisbane, Perth, Adelaide, Wellington and Auckland. To meet insurer’s needs, the firm also has an active presence in the London and Singapore markets and continues to actively recruit.

Legalign Global alliance member Wotton + Kearney has entered a partnership with investment firm Straight Bat. This move will assist the firm to accelerate its ambitious client solutions and growth objectives.

Under the deal, Straight Bat is taking a minority stake in Wotton + Kearney, providing insight and governance with two non-executive board appointments and injecting equity and corporate expertise into our business.

The partnership allows Wotton + Kearney to make a significant investment in accelerating the delivery of its strategy, which involves attracting the best talent in key insurance lines, capturing new market opportunities and investing in legal tech to benefit its clients.

It reinforces the firm’s ongoing commitment to deliver expertise across a greater number of insurance products from more places across the region. Recently, this commitment has seen Wotton + Kearney expand its teams in core areas like major loss property, energy and infrastructure, as well as in speciality lines, such as health, cyber and marine. The firm has also recently opened its seventh office in Adelaide.

Wotton + Kearney’s strategy also responds to the growing need to increase our investment in legal technology and data-driven client solutions. This is critical as many insurers are looking to leverage data to assist with risk selection, risk mitigation and appropriate pricing.

Straight Bat is a private equity fund that invests for the long-term in mature, robust, profitable, medium-sized Australian businesses and assists its business partners to deliver their strategic plans. For their part, the Straight Bat team were impressed by Wotton + Kearney’s standing in the insurance market and are excited about bringing their broader business skills to the firm’s evolving growth story.

As part of the partnership arrangements, Wotton + Kearney has appointed two new non-executive directors, Rob Nicholls and Steve Gledden. Steve Gledden is a former McKinsey & Co consultant who has 25+ years’ experience in professional services, private equity and venture capital in Australia and the United States. Rob Nicholls has diverse strategy, governance and business growth experience, including five years as a CEO growing the national footprint of an industrial services business and 20+ years at Westpac and in M+As.

Our congratulations go to DAC Beachcroft’s Hans Allnutt who has been nominated as Cyber Risk Person of the Year (London category) in the prestigious 2022 Advisen Cyber Risk Awards. Also nominated is Wotton + Kearney’s Kieran Doyle (Cyber Risk Person of the Year – rest of world) and our Legalign Global colleagues at Wilson Elser (Cyber Law Firm of the Year).

The Advisen Cyber Risk Awards are determined by industry peer nomination and online votes. People at the same firm as the nominated individual are not allowed to vote for them under the award rules. However, we encourage others to vote for Hans, Kieran and Wilson Elser here. Voting remains open until 27 May.

Legalign’s Cyber team are thrilled to be speaking today at the Advisen Cyber Risk Insight Conference in London as part of the Legalign week. Julian Miller will be on the keynote panel discussing Cyber War Exclusions and Eleanor Ludlam, Kieran Doyle, Joseph Fitzgerald, Franz Konig and Anjali Das will be discussing cross-border legal perspectives for the UK, Australia, New Zealand, Germany and US on a panel chaired by Hans Allnutt.

#BreakingTheBias – Breaking Bias through allyship

In our final Legalign Global video celebrating International Women’s Day, we hear from Celena Mayo, Ryan Howe and Scott Macoun on breaking bias through allyship, the power of mentoring and the role that men can play to create a gender equal future

#BreakingTheBias – Lawyers don’t come in one shape or form

To celebrate International Women’s Day 2022, our Legalign colleagues have once again joined together to create a series of videos to share real stories from across our network in support of this year’s theme – #BreakTheBias. In the first of three videos Caitlin Barclay, Caroline Cherry, Katja Labusga and Celena Mayo talk about their own career journeys to explain why lawyers don’t need to come in one shape or form.

#BreakingTheBias – Overcoming parental leave and career bias

In our second Legalign Global video addressing this year’s International Women’s Day theme #BreakTheBias,we hear from Brooke Johnston, Scott Macoun, Emma Ferguson, Yoora Pak and Friederike De Biasi on how their own experiences of balancing a busy career with time away as a primary caregiver is helping to overcome parental leave and career bias and set a path for others.

DAC Beachcroft in collaboration with Legalign has published over 150 insurance predictions on Informed Insurance for 2022.

Making predictions about the future of the insurance market is not for the faint-hearted, but our international experts have looked ahead at the opportunities and challenges that the insurance market may face in the coming year and beyond.

Both our thought leadership articles and predictions are categorised into six themes, with the predictions also available in 17 different classes of insurance business.

The insurance predictions are categorised by six key themes:

Helen Faulkner, Global Head of Insurance at DAC Beachcroft, commented: “We hope insurers will find our insights valuable in planning for the future. There is a significant overlap in environmental, social and governance (ESG) issues that we are seeing emerge, which highlights a sweet spot on which to focus our attention in the year ahead to create a resilient industry of which we can all be proud.

Eleanor Ludlam of DAC Beachcroft and Anjali Das of Wilson Elser were among the 21 women selected for the IT Security Guru’s Most Inspiring Women in Cyber Awards 2021. The awards show, hosted by IT Security Guru and sponsored by KPMG and Beazley, was held in Canary Wharf, London, on November 30, 2021, to honour women who break the stereotype of cyber as a male-dominated industry and serve as role models to other women in the field.

Read the full press release below.

Informed Insurance

The home of fresh thinking about key insurance topics by subject matter experts from around the world.

Thought leadership

We curate our thought leadership around the insurance topics that matter most.

Predictions

We anticipate issues and opportunities for clients and share our future-focused insights in this annual report.

Themes

Our themes highlight key issues for the insurance sector, from class actions to technology.