Insights

The DAC Beachcroft January Data, Privacy and Cyber Bulletin includes highlights of the 2024 Cyber Predictions, European Data Act, Use of AI, Enforcement of DPOs and Adtech under challenge.

Click on the link below to read about Yahoo being fined 10 million EUR for its cookie policies or for an update on the ‘pay or ok’ mechanism being challenged by European Data Protection boards.

With contributions from across the firm, get in touch with Hans Allnutt, Patrick Hill or Jade Kowalski for any further information or to sign up for this monthly newsletter.

Angela Russell (Partner-Baltimore, MD) collaborated with DAC Beachcroft colleagues Peter Allchorne, Hamza Drabu and Charlotte Halford on a September 28, 2022, article released in conjunction with Legalign Global. “Sustainability Through Technology: Managing the Transition,” part of DACB’s new thought leadership campaign – Unlocking the potential of ESG: resilience, sustainability and collaboration – posits the “UK could become a centre of technological excellence and create an environment that attracts, supports and retains the entrepreneurial starts-ups that will drive the global economy in the future, but to achieve this it will need to evolve its regulatory and legislative frameworks.”

Speaking to technology and liability in the health care arena, Angela noted, “There was a lot of concern about a wave of litigation on the back of the increased use of telemedicine. I have now been speaking about it for more than 10 years and the influx of litigation has not happened.” Rather, she says, increased use of telemedicine “is prompting moves to more national legislation and the development of more interstate agreements around the local licenses needed to practice medicine.”

From kindergarten through law school, there was always something to stress me out. Homework, tests, in-school assignments – along with the pressure to do well and the need to complete a project in an allotted time – could be paralyzing. To individuals with disabilities, the stress is often worse. Not only do they have similar concerns, but the thought that the materials may not be accessible in the format in which they can best learn or be tested is frustrating, and can be terrifying. In response, lawyers have figured out a way to make educators and educational institutions aware of the issue – through the looming threat of a class action lawsuit.

While many institutions of higher education believe they are accommodating and inclusive, the barriers presented by non-accessible websites and materials pose significant risk to these institutions and concern for their leaders. Institutions for education are common targets for web accessibility claims and will remain so for the foreseeable future. The constantly rotating mix of students who apply to and attend school each year presents institutions with a bevy of new potential plaintiffs with different disabilities and unique experiences. As such, a school must continually monitor its compliance and strive to be accessible.

Agricultural scientist and inventor George Washington Carver said, “Education is the key that unlocks the golden door to freedom.” When the ability to obtain an education is hampered by barriers to access, the system fails and the students’ opportunities can be lost. In response, the government has instituted safeguards and laws to protect the rights of students in both the public and private sectors.

The Laws Protecting People with Disabilities

Former U.N. Secretary General Kofi Annan recognized that “Knowledge is power. Information is liberating. Education is the premise of progress in every society, in every family.” Similarly, decades ago, the United States government recognized the need to provide proper protections for people with disabilities from disability-based discrimination and to move toward a more inclusive society. Through the Rehabilitation Act of 1973 and the Americans with Disabilities Act of 1990, the federal government took steps to provide reasonable accommodations so that people with disabilities do not become the disenfranchised.

Title II of the Americans with Disabilities Act (ADA) provides in section 35.130 that:

(a) No qualified individual with a disability shall, on the basis of disability, be excluded from participation in or be denied the benefits of the services, programs, or activities of a public entity, or be subjected to discrimination by any public entity.

Similarly, in Title III of the ADA (section 36.201), the statute provides:

(a) Prohibition of discrimination. No individual shall be discriminated against on the basis of disability in the full and equal enjoyment of the goods, services, facilities, privileges, advantages, or accommodations of any place of public accommodation by any private entity who owns, leases (or leases to), or operates a place of public accommodation.

By definition, a place of public accommodation “means a facility operated by a private entity whose operations affect commerce and fall within at least one of the following categories … (10) A nursery, elementary, secondary, undergraduate, or postgraduate private school, or other place of education.”

As such, regardless whether a school is a public or private institution, the ADA prohibits discrimination against an individual with a disability.

Individuals with disabilities also are protected against inaccessible school websites under sections 504 and 508 of the Rehabilitation Act of 1973. Section 504 (29 USC 794(a)) of the Act provides:

No otherwise qualified individual with a disability in the United States … shall, solely by reason of his or her disability, be excluded from the participation in, be denied the benefits of, or be subjected to discrimination under any program or activity receiving Federal financial assistance or under any program or activity conducted by any Executive agency …

Further, section 508 of the Rehabilitation Act of 1973 (29 USC 794d) requires federal agencies and organizations receiving federal funds to make electronic information and information technology accessible for people with disabilities. Specifically, the law requires:

(1) Accessibility

(A) Development, procurement, maintenance, or use of electronic and information technology

When developing, procuring, maintaining, or using electronic and information technology, each Federal department or agency, including the United States Postal Service, shall ensure, unless an undue burden would be imposed on the department or agency, that the electronic and information technology allows, regardless of the type of medium of the technology,

(i) individuals with disabilities who are members of the public seeking information or services from a Federal department or agency to have access to and use of information and data that is comparable to the access to and use of the information and data by such members of the public who are not individuals with disabilities.

Institutions of learning, whether public or private, are therefore required to provide accommodations to people with disabilities when providing them with educational materials or other electronic information.

To ensure accessibility, the World Wide Web Consortium (W3C) has issued the Web Content Accessibility Guidelines (WCAG) international standard, including WCAG 2.0, WCAG 2.1 and WCAG 2.2, which explain how to make web content more accessible to people with disabilities. These are highly technical guidelines that might not be readily understood by risk managers or educators, but rather are routinely addressed by technology professionals. However, most complaints address a few major areas of concern, and website operators need to be cognizant of the following:

- Alt Text for Images – alternative text that allows a vision-impaired individual the ability to understand the presence, function and content of images on a site

- Link Text – text that allows a user to navigate a website and links to other webpages, documents and content

- Form Labels – text that allows a user to understand forms on webpages

- Keyboard Navigability – functionality that allows a user to navigate a website using a keyboard instead of a mouse

- Captions – for all audio and video content

- Proper Headers, Lists and Tables – functionality and formatting to allow a user to understand the ordering of content

- No Flashing Graphics – graphics that flash have been known to inadvertently cause seizures in certain individuals.

Lack of Compliance Leads to Litigation

Despite the requirement that educational institutions comply with accessibility standards, most institutions do not comply. While schools have learned how to assist students with disabilities through physical and structural accommodations (such as ramps, automatic door openers and close parking spots), a lag in compliance with digital access still exists. Institutions of higher education often place the onus of communicating the necessary accommodations on students, and educational institutions often leave the communications with students to teachers and others who may not be as familiar with the accessibility rules as needed. With the growth in the importance of digital education, especially since COVID-19 pushed a greater proportion of learning online, the divide in digital compliance has become even deeper.

When COVID-19 first took hold and forced the migration of learning from an in-person classroom to an online experience, not everyone was prepared. A teacher who had accommodations set up in a classroom, might not know how to adjust them to the online environment. The use of vendors in assisting with the educational forum has taken on greater importance. With the outsourcing of certain aspects of learning comes a lack of control in ensuring that students with disabilities are provided with proper accommodations.

The description of an assignment online in a PDF format, or through instructions given on a website or module provided by a software vendor, now requires thought as to whether the accommodations agreed to in a written plan with the school are being addressed. These and many other questions have arisen due to the rapid increase in online learning:

- Do the contracts that the schools entered into with the vendors provide for ADA accommodations?

- Do the vendors have the ability to deliver compliance?

- Are the institutions indemnified?

- Do the teachers/professors or their administrative aides have the understanding and skills to recognize and deliver the accommodations?

Many schools and universities have been subjected to ADA web accessibility claims. It has been reported that Marcie Lipsett, founder and co-chair of the Michigan Alliance for Special Education, filed more than 2,400 web accessibility complaints against schools and districts under Title II, with more than 1,000 resulting in resolution agreements with the Office of Civil Rights.

In November 2018, Jason Camacho, a blind resident of Brooklyn, New York, commenced suit against 50 colleges and universities over the lack of accessibility of their websites. Mr. Camacho had allegedly attended a career fair where these schools were present, and claimed that when he attempted to obtain more information online, accessibility barriers prevented access. Mr. Camacho claimed that when he attempted to use a screen reader, which allows visually impaired individuals to receive the text and description of images on the screen through audible messages or braille, he was unable to access the schools’ website information with the assistive device. Although at least one school challenged jurisdiction and lost; settlements followed quickly.

Even the hallowed Harvard University could not escape suit. In 2015, a class action lawsuit was filed against Harvard alleging that many of its videos and audio recordings lacked captions or used inaccurate captions, despite the fact that Harvard promoted its online resources as being available to “learners throughout the world.” Harvard reached a settlement that was followed by an announcement from the National Association of the Deaf that Harvard would institute a series of new guidelines to make the school’s website and online resources accessible to those who are deaf or hearing impaired.

These lawsuits continue. In July 2021, a prospective student filed suit against Syracuse University alleging that the site was inaccessible and that he, along with other individuals who are blind or vision-impaired, faced “significant barriers” in applying to the school.

These lawsuits will likely continue until schools and universities pay more attention to the issues confronting students with disabilities.

AAAtraq Releases Study Showing Continuing Problem

Despite the surge in lawsuits and the increasing awareness of the risk, most websites still fail to achieve the technological standards followed to judge accessibility. AAAtraq, a compliance identification and management system vendor, analyzed the home pages of more than 2,000 higher education institutions and found that 96 percent of them failed to be inclusive. The study looked at the three most often cited vulnerabilities of sites:

- Missing, inadequate or incorrect alternative text (Alt text) used to interpret images on a webpage

- Missing, inadequate or inaccurate link text (which is used to describe a link that allows one to navigate a website or connects to another webpage, document, video or other linked content

- Missing, inadequate or improperly described form labels (form field labels allow a user with disabilities to understand the information being requested to be input).

AAAtraq found that 13 percent of the institutions of higher education had a very high risk of being targeted due to the extent of failures on their home page, with another 48 percent of the institutions being classified as high risk. While 4 percent of the institutions were classified as low risk, AAAtraq noted that the results were based on an audit of the homepage of the institution’s primary website. With a “more in-depth audit,” AAAtraq believes that “it’s highly likely that failures could be identified on every website.”

The time is now for schools and universities to pay attention and start the process of making their digital presence inclusive to reduce the potential for being sued and enhance the ability to muster a defense if sued. In addition it will make such institutions more inclusive to an important demographic. American broadcast journalist Walter Cronkite once said “Whatever the cost of our libraries, the price is cheap compared to that of an ignorant nation.” Similarly, while there is a cost of compliance, the cost of failing to comply is much greater.

On May 19, 2022, the Ninth Circuit Court of Appeals issued an unexpected ruling that hemp-derived delta-8 THC falls within the definition of “hemp” under the 2018 Farm Bill. The Court’s decision in AK Futures LLC v. Boyd St. Distro, LLC, No. 21-56133, 2022 U.S. App. LEXIS 13526, affirmed a preliminary injunction granted by the district court in favor of the appellant, finding that its Cake-branded delta-8 THC vape products are legal under the 2018 Farm Bill, and that the appellant is therefore entitled to “traditional” federal protections that include trademark protection under the federal Lanham Act.

This decision has broad implications for the future of delta-8 THC as federal and state authorities grapple with the sudden popularity of these unregulated intoxicating products. This article examines the underlying dispute over delta-8 THC’s federal legality, and the AK Futures opinion and its likely impact on the hemp and marijuana industries, as well as on the insurance companies that insure them.

Popularity of Delta-8 THC Products as “Legal High”

Eighteen months ago, most cannabis industry experts anticipated that the cannabinoids CBG (cannabigerol) or CBN (cannabinol) would become the next popular “novel” cannabinoid to follow the explosive popularity of CBD (cannabidiol). The sudden popularity of hemp-derived delta-8 THC was largely a surprise, driven by media reports that it allows for a “legal high.” Delta-8 THC products have quickly become a popular alternative to heavily regulated and more expensive marijuana products that have higher concentrations of delta-9 THC, the primary psychoactive and intoxicating cannabinoid in marijuana.

Delta-8 THC also is psychoactive and intoxicating, similar to delta-9 THC. The two cannabinoids are molecularly identical but for the placement of one double bond. Studies around delta-8 THC are limited, but the present consensus is that it has about two thirds of the intoxicating potency when compared with delta-9 THC. The National Center for Biological Information describes delta-8 THC as having antiemetic, anxiolytic, analgesic, appetite-stimulating and neuroprotective properties.

The Basis of the Dispute over Delta-8 THC’s Federal Legality

The issue that has perplexed cannabis lawyers over whether delta-8 THC products are legal under federal law involves how delta-8 THC is created. Delta-8 THC is not expressed in adequate concentration in most hemp varieties to make its extraction functionally viable. It is economically feasible, however, to convert hemp-derived CBD into delta-8 THC. Indeed, the current oversupply of CBD has caused its price to drop, with CBD suppliers looking for alternative outlets for their product. Almost all delta-8 THC products on the market therefore contain delta-8 THC that is derived from the chemical conversion of CBD, not through direct extraction from the hemp plant.

It has been essentially undisputed that delta-8 THC that is directly extracted from legally cultivated hemp is lawful. The 2018 Farm Bill’s definition of “hemp” includes all cannabinoids with a delta-9 THC concentration that does not exceed 0.3% on a dry weight basis. Under this legal definition, delta-8 is treated no differently than CBD or any of the more than 100 cannabinoids that may be directly extracted from the hemp plant. All of those cannabinoids have been removed from regulation under the Controlled Substances Act (CSA), including delta-8 and delta-9 THC, so long as the delta-9 THC concentration is no more than 0.3% on a dry weight basis.

Although delta-8 THC is not a federally controlled substance when extracted from hemp directly, it is a controlled substance when extracted from marijuana. This distinction between a cannabinoid’s legal status depending on whether it is extracted from marijuana or hemp is known among cannabis lawyers as the “Source Rule.”

One common view has held that delta-8 THC products created through chemical conversion from hemp-derived CBD are illegal “synthetic” THC. In August 2020, the Drug Enforcement Administration (DEA) released its interim final rule stating in part that “all synthetically derived tetrahydrocannabinols remain Schedule 1 controlled substances.” The DEA reiterated this position in its September 2021 non-binding opinion letter on delta-8 THC to the Alabama Board of Pharmacy, stating that delta-8 is a synthetic THC that falls outside the protections afforded by the 2018 Farm Bill. The CSA explicitly lists “synthetic THC” as a Schedule 1 controlled substance. The term “synthetic THC,” however, has never been clearly defined either by statute or through a court ruling. Although delta-8 THC certainly is produced in a laboratory from CBD, the end product is molecularly identical to the chemical structure of delta-8 THC that occurs in nature.

It is against this backdrop that the Ninth Circuit was tasked with deciding whether AK Futures could invoke federal trademark protections for its Cake-branded delta-8 THC vape products.

The AK Futures Opinion

AK Futures is a manufacturer and distributor of delta-8 THC products under the “CAKE” brand – a logo depicting a two-tier cake overlaid with a stylized letter “C.” AK Futures sued Boyd St. Distro, LLC (Boyd Street), a wholesaler of smoke and vaping products, for trademark and copyright infringement for allegedly selling virtually identical Cake-branded vapes. The district court granted AK Futures’s preliminary injunction, finding that the 2018 Farm Bill legalized the company’s delta-8 THC products.

On appeal, Boyd Street did not deny that it sold counterfeit Cake-branded vape products. It instead presented two chief arguments: (1) legalized hemp does not extend to delta-8 THC, and (2) Congress never intended for the Farm Bill to legalize intoxicating substances.

In support of its first argument, Boyd Street relied on the DEA’s position that delta-8 THC is an illegal Schedule 1 synthetically derived THC. In response, AK Futures asserted that the Farm Act’s definition of “hemp” encompasses hemp-derived delta-8 THC products so long as they contain no more than 0.3% delta-9 THC.

The Ninth Circuit Appellate Court held that the “plain and unambiguous” text of the Farm Bill indicated that delta-8 THC products were lawful. The Farm Bill removed “hemp” from Schedule I of the CSA, where “hemp” is defined as “the plant Cannabis sativa L. and any part of that plant, including … all derivatives, extracts, [and] cannabinoids … with a delta-9 concentration of not more than 0.3%.” The Court further noted that the delta-9 THC concentration level was the only statutory metric for distinguishing marijuana from hemp, and that the terms “derivative, extract, or cannabinoid” were substantially broad. The Court concluded that “hemp” encompasses delta-8 THC products that contain no more than 0.3% delta-9 THC.

In support of Boyd Street’s argument that Congress never intended for the Farm Bill to legalize intoxicating products such as delta-8 THC, Boyd Street essentially proposed that the Ninth Circuit limit products legalized by the Farm Bill to those suited for an industrial purpose, and not for human consumption. Noting that this limitation appears nowhere in the Farm Bill or the CSA, and refusing to “muddy” clear statutory language, the Ninth Circuit ruled that “regardless of the wisdom of legalizing delta-8 THC products, this Court will not substitute its own policy judgment for that of Congress” and that if an inadvertent loophole was created, “then it is for Congress to fix its mistake.”

Ultimately, the Ninth Circuit found that AK Futures’s use of the trademarks in commerce was lawful and could give rise to trademark priority. Notably, the Court recognized that AK Futures screens its products for “heavy metals, pesticides, and other contaminates,” but it cannot test counterfeits. Because federal trademark law “allows consumers to distinguish between brands that take consumer health seriously …and those that do not,” the Court found that the public interest also favored an injunction. As such, the Ninth Circuit affirmed the district court’s grant of a preliminary injunction in AK Futures’s favor and remanded the case for further proceedings.

The Impact

The AK Futures decision should give a boost to the delta-8 THC product market by providing additional clarity on the legality of those products under federal law. This comes with various benefits and risks, discussed below.

Trademark and Copyright Implications

As the first federal ruling on the legality of delta-8 THC products, the Ninth Circuit Court’s broad interpretation of “hemp” under the Farm Bill is a win for companies seeking trademark protection for hemp-derived products. Given the ever-evolving changes in cannabis law and hemp-derived products, however, the assistance of knowledgeable trademark counsel becomes crucial to assist with the filing and registration of a trademark application for hemp-derived products with the United States Patent and Trademark Office (USPTO). An experienced trademark attorney can advise regarding the use and registration of the hemp-derived product and decrease the possibility of costly legal problems by ensuring proper due diligence that includes a comprehensive clearance search prior to submitting a trademark application with the USPTO. It also is important to understand how the ongoing rulemaking by the Food and Drug Administration (FDA) on ingestible hemp-derived cannabinoids may prevent USPTO approval for certain delta-8 THC products regardless of the ruling in AK Futures.

Conflict with Regulated Marijuana Industry

Notwithstanding the potential economic opportunities around delta-8 THC, many fear that its sudden popularity threatens to undermine the hemp, CBD and regulated marijuana industries. There is concern that because delta-8 is an unregulated cannabis product that causes intoxication, it may damage the regulated marijuana industry by alarming politicians, local leaders and law enforcement. The U.S. Cannabis Council, for example, has issued a public statement urging that “all forms of THC, regardless of chemical variant, isomer or ‘delta level,’ should be regulated as intoxicating THC in adult use products” and that “delta-8 products should be sold only where regulated, tested and labeled THC products are available.”

What has emerged is a split between those who see delta-8 THC as a means to revive a flagging hemp and CBD industry versus those who see delta-8 as a dangerous uninvited “party crasher” to the cannabis industry that may give rise to substantial liability and reputational harm. The AK Futures ruling certainly gives a boost to those on the pro-delta-8 THC side of the debate.

Product Contamination, Adulteration and Label Concerns

The immediate fallout from the AK Futures decision will likely result in exacerbating the problem of largely unregulated delta-8 THC products becoming more widespread. The chemical conversion process from CBD to delta-8 THC can produce unknown byproducts as high as 30% to 50% of the converted batch, depending on the conversion process used. This may include chemicals such as acetic acid, bleach and other solvents that are used in the conversion process. Also, since delta-9 THC is created during the conversion process, separating the two almost-identical cannabinoids can be difficult. Many labs do not have the proper expertise, equipment or validation methods in place to properly separate delta-8 from delta-9 THC.

Label inaccuracies and outright fraud are pervasive within the hemp cannabinoid market. Delta-8 THC products often are marketed with misleading or false claims. Many products are marketed as “hemp derived,” “natural” or “THC free,” and many delta-8 THC products fail to incorporate any explicit warning of intoxicating effects. A recent survey by CBD Oracle found label inaccuracies in over 75% of the delta-8 THC products. Most problematic, a large majority of products tested had over 0.3% concentration of delta-9 THC, meaning that they are Schedule 1 controlled substances that can give rise to substantial criminal exposure.

Delta-8 THC and the FDA

On May 4, 2022, the FDA issued its first warning letters to five companies for selling products labeled as containing delta-8 THC in ways that violate the Federal Food, Drug, and Cosmetic Act (FD&C Act). The warning letters address the illegal marketing of unapproved delta-8 THC products by companies as unapproved treatments for various medical conditions or for other therapeutic uses. The letters also cite violations related to drug misbranding as a result of inadequate directions for use and for other reasons, as well as the addition of delta-8 THC in foods.

In a public statement issued concurrently with the warning letters, FDA Principal Deputy Commissioner Janet Woodcock, M.D. stated: “The FDA is very concerned about the growing popularity of delta-8 THC products being sold online and in stores nationwide. These products often include claims that they treat or alleviate the side effects related to a wide variety of diseases or medical disorders, such as cancer, multiple sclerosis, chronic pain, nausea and anxiety.” Dr. Woodcock also called it “extremely troubling” that some delta-8 THC food products are packaged and labeled in ways that may appeal to children.

Similar to the FDA’s analysis around CBD, any future determination by the FDA as to whether delta-8 THC may be added to food or dietary supplements would be based on evidence of its safety for human consumption. This would normally be performed through the premarket approval process involving “generally recognized as safe” (GRAS) applications and new dietary ingredient (NDI) notifications, which involve lengthy and expensive evidence-based data.

Delta-8 THC and State Law

Regardless of any clarity provided by AK Futures on the legality of delta-8 THC under the Farm Bill, legality under state law varies widely and a number of states have taken action on delta-8 THC products. States vary in their respective definitions of “hemp” under state law. Some states have adopted the definition of hemp contained in the 2018 Farm Bill, while others use definitions that leave out derivatives, isomers or other forms. A few states have expressly included delta-8 THC on their list of controlled substances and several others regulate delta-8 THC as they would marijuana.

Currently, delta-8 THC is subject to strict limitations or outright bans in approximately 20 states. There are lawsuits pending in Texas and Kentucky that may determine the legality of delta-8 THC in those states. Several state legislative bans are under consideration, and we expect more states to follow suit, notwithstanding the AK Futures ruling, due to public health and safety concerns.

Implications for the Insurance Industry

The AK Futures decision is prompting a reconsideration by some insurance companies that have until now refused to insure delta-8 THC products. Insurers should proceed cautiously. Intoxicating hemp-derived products add another level of hazard onto an already risky venture. Even non-intoxicating hemp products such as CBD and CBG generally have a higher risk profile than regulated marijuana due to the lack of strict testing requirements and the resulting contamination, label errors and fraud discussed above.

Misbranded and adulterated delta-8 THC products give rise to possible civil abatement by regulatory authorities, liability under consumer protection statutes and potential criminal exposure. One should expect to see more civil court cases filed in connection with delta-8 THC products, including consumer class actions similar to the earlier wave of such litigation filed against CBD products.

Insurers must recognize that underwriting delta-8 THC necessitates a flexible state-specific analysis, similar to the analysis for CBD products. Forms and underwriting procedures should be reviewed regularly to ensure that they adequately reflect the current underwriting intent for insureds that manufacture, distribute or sell delta-8 THC products. Policy definitions, endorsements, exclusions and application questions should be revisited and updated as state law, known risks and market conditions change.

Wilson Elser’s Cannabis Law (Nationwide) and Insurance (Texas) practices were named to the prestigious Chambers USA 2022 Guide. Six attorneys were individually ranked.

Chambers USA is the leading legal directory, ranking the top lawyers and law firms across the United States. The legal rankings are based on in-depth market analysis and independent research, all conducted by a Chambers dedicated team of researchers.

This year, the firm expanded its Chambers presence to include an attorney ranking for Price Collins, co-chair of the Insurance & Reinsurance Coverage Practice and regional managing partner of the firm’s Dallas, Texas, office, and a practice ranking for Insurance – Texas.

The Chambers USA 2022 rankings for Wilson Elser

Two firm practice rankings:

Firm – Texas – Insurance

Firm – Nationwide – Cannabis Law

Six individual attorney rankings:

Price Collins – Texas – Insurance

Thomas Quinn – New Jersey – Insurance

Dean Rocco – Nationwide – Cannabis Law

Antonio Rodriguez – Nationwide – Transportation: Shipping/Maritime Litigation (Outside New York)

Ian Stewart – Nationwide – Cannabis Law

Thomas Tobin – Nationwide – Transportation: NTSB Specialists

Learn how Chambers conducts its research:

Research Methodology | Chambers and Partners

Lateral Hire Brings Significant London Market Experience

Wilson Elser has announced that Graham Pulvere has joined the firm as a partner in its Birmingham, Alabama, office.

Pulvere concentrates his practice on litigating insurance coverage and bad faith actions in addition to a variety of professional liability matters. He was previously a partner at Lloyd Gray Whitehead Monroe in Birmingham, where he practiced in the Insurance Coverage and Professional Liability groups, handling matters in the U.S. and London insurance markets.

At Wilson Elser, Pulvere will be a member of the Insurance & Reinsurance Coverage and the Professional Liability & Services practices, as well as the London Practice.

“Graham has significant experience working with the London market on first-party and bad faith matters and will add to our strong ability to handle complex coverage and bad faith matters not only in Alabama but also in Mississippi and Louisiana,” said London Practice Chair David Holmes.

“As the nation’s preeminent defense litigation law firm, our sweet spot is insurance,” said David Hall, Regional Managing Partner of the Birmingham office. “Graham adds to our deep bench in that area, and we extend him an enthusiastic welcome to Wilson Elser.”

Focused in the area of first-party and third-party insurance coverage matters, Pulvere handles various first-party matters including claims involving catastrophes, suspected burning, fraud, theft losses, and commercial property and business interruption losses. Additionally, he handles first- and third-party bad faith matters including excess policy claims.

Pulvere has represented clients in a range of areas such as legal malpractice actions, bar disciplinary proceedings, and errors and omissions actions against insurance agents and brokers. He handles litigation, arbitration and mediation in a number of states.

Pulvere received a J.D. degree from Samford University Cumberland School of Law in 2003, and a B.S. degree from Utah State University in 1998.

Wilson Elser has been certified a Gold Standard Firm by the Women in Law Empowerment Forum (WILEF). The WILEF recognizes women attorneys from the largest law firms and corporate law departments in the United States, London and Paris. The organization’s highest honor, Gold Standard Certification, requires a U.S. law firm to have a total of at least 300 practicing attorneys and to meet certain mandatory criteria for women, and women of color, included among the equity partnership and serving as office heads, participating on governance and compensation committees, and relating to compensation. Wilson Elser met these stringent criteria and was granted certification on its first application.

“Wilson Elser is proud to be named a WILEF 2022 Gold Standard certified law firm,” said Carolyn O’Connor, Chair of Wilson Elser’s Women Attorneys Valued & Empowered (WAVE). “The certification is further evidence of how Wilson Elser not only values creating a diverse, inclusive culture but also practices those values and, indeed, is among the industry leaders in supporting women attorneys.” Angela Russell, Chair of the firm’s Diversity & Inclusion Committee, adds, “WILEF’s recognition is especially gratifying given our strategic vision for the future and the integral role our women attorneys will play.”

Learn more about the Women in Law Empowerment Forum as well as Wilson Elser’s WAVE and related initiatives.

Legalign Global alliance member, Wotton + Kearney, is opening its eighth office in Australia’s capital city, Canberra in September 2022.

David Kearney, Wotton + Kearney’s Chief Executive Partner, said: “We have been keen to grow our government and insurance practice to support our clients in Canberra for some time but didn’t want to do so without the right team and leader to spearhead our move. With the arrival of Cath Power, arguably one of the most respected insurance lawyers in Australia, and her team who join us from Sparke Helmore, we are confident we have done just that”.

The firm’s move into Canberra is the latest chapter in its strong Australasian growth story. It follows the recent opening of Wotton + Kearney’s Adelaide office and several recent senior appointments across its Property, Energy & Construction, Financial Lines and General Liability practices and in the specialty lines of Cyber, Marine & Transport and Health.

Wotton + Kearney now has more than 340 dedicated insurance lawyers, including 62 partners, across Sydney, Melbourne, Brisbane, Perth, Adelaide, Canberra, Wellington and Auckland. To meet insurers’ needs, the firm also has an active presence in the London and Singapore markets.

We are pleased to announce 25 lawyer promotions in Australia and New Zealand, including five new partners, two special counsel and 13 senior associates, effective 1 July 2022.

In our 20th year, it is wonderful to see Wotton + Kearney continuing to grow so strongly. The promotion of new partners Cassandra Wills (Brisbane), Patrick Thompson (Sydney), Yen Seah (Melbourne), Ronnie Mok (Brisbane) and Edward Burrell (Sydney) adds to our growth story. We now have 62 partners, including Marie-Clare Elder, Claudine Watson-Kyme, Peter Leman, Caroline Laband and Misha Henaghan, who joined in January 2022.

Cassandra Wills and Patrick Thompson are the latest partners to join our General Liability team.

Cassandra specialises in public liability claims, routinely advising on coverage, liability and recovery prospects under various policies of insurance. She has extensive experience dealing with personal injury and historical abuse claims under both PIPA and the WCRA.

Patrick specialises in public sector litigation and has an extensive background in professional indemnity and public liability claims, including assisting clients to navigate the sensitivities of the abuse claims sector. He acts primarily on behalf of government entities, including police, health, ambulance and child welfare agencies.

Our Financial Lines team is also being boosted with the promotion of Yen Seah and Ronnie Mok.

Yen’s practice focuses on claims arising under directors and officers, professional indemnity, and management liability policies of insurance. She has extensive experience in acting as coverage and monitoring counsel in large-scale, high value litigation, including shareholder class actions.

Ronnie is known for his expertise in professional indemnity, management liability, and directors and officers liability. With broad industry experience, he manages large-scale disputes that often involve multiple parties and stakeholders, and complex liability and quantum issues.

Our Major Loss Property team is being further strengthened with Edward Burrell’s promotion. Edward, who previously worked in-house at a Tier 1 D&C contractor, specialises in coverage advice and claims strategies for mega-losses and other large-scale litigation in the property and construction sectors.

Congratulations also to our other promoted lawyers:

- Special Counsel – Christy Mellifont (Melbourne, Financial Lines) and Karren Mo (Melbourne, Financial Lines).

- Senior Associate – Jessica Chapman (Sydney, Financial Lines), Maddison Fairthorne (Melbourne, General Liability), Isobel Howie (Sydney, General Liability), Lily Kidman (Sydney, General Liability), Petra Kolovos (Melbourne, Financial Lines), David Lucas (Sydney, Property, Energy & Infrastructure), Julia Marchesi (Melbourne, Financial Lines), Connor Molloy (Sydney, General Liability), Sarah Sackville (Sydney, General Liability), Natalie Sinclair (Sydney, General Liability), Jeremy Thomson (Wellington, Financial Lines & General Liability), Vicki Thorpe (Melbourne, General Liability) and Kristyn Winner (Sydney, Property, Energy & Infrastructure).

- Associate – Jemma Callanan (Sydney, General Liability), Kaila Hart (Sydney, Financial Lines), Andrew Salinas (Sydney, Financial Lines), David Smith (Auckland, Financial Lines) and Louis Van Bergen (Perth, General Liability).

Today, W+K welcomes two new Health partners: Marie-Clare Elder and Claudine Watson-Kyme. The combination of our new Sydney-based partners and Partner Chris Spain in Melbourne creates a formidable, fresh Health team.

Both Marie-Clare and Claudine come from senior in-house roles, have medical backgrounds and are widely respected for the advice and support they provide to medical and allied health professionals.

Marie-Clare Elder specialises in health, medical negligence and personal injury litigation. She has practised in Australia and the United Kingdom in senior in-house roles and is a former clinical nurse specialist in intensive care. Most recently, Marie-Clare was the Senior Legal Counsel – Manager Legal Services at MIGA, where she was responsible leading the eastern seaboard team and for general legal advice and litigated claims, coronial inquests, disciplinary and employment matters.

Claudine Watson-Kyme is a health law specialist with extensive experience in litigation and dispute resolution. During her career, Claudine has represented and advised NSW health agencies, medical indemnity insurers, hospitals, medical practitioners and allied health providers. Her experience spans liability claims, coronial inquests, disciplinary and administrative law matters. She is a former nurse and, most recently, was the Manager of Cases and Advisory Services at MDA National.

With their in-house experience, Chris, Marie-Claire and Claudine are reinventing the traditional healthcare offering and creating something genuinely different for the market in terms of price, service and an empathetic and practical approach to claims management. Our offering will be tailored to meet the diverse needs of the health sector, including medical negligence claims, disciplinary matters, coronial inquiries, advisory services and employment law support.

Wotton + Kearney has again joined forces with Liberty Specialty Markets and ANZIIF to investigate how experiences of workplace inclusion are affecting the insurance industry.

More than 400 ANZIIF members and industry participants shared their views on inclusion via the online survey to inform our Deep Dive on Inclusion Survey Report 2021.

The report is written by Dr Jennifer Whelan, Director of Psynapse Psychometrics, a leading expert on inclusion. It highlights that inclusion remains an important issue for the insurance industry, particularly given the broader work-related challenges we have all continued to face during the pandemic.

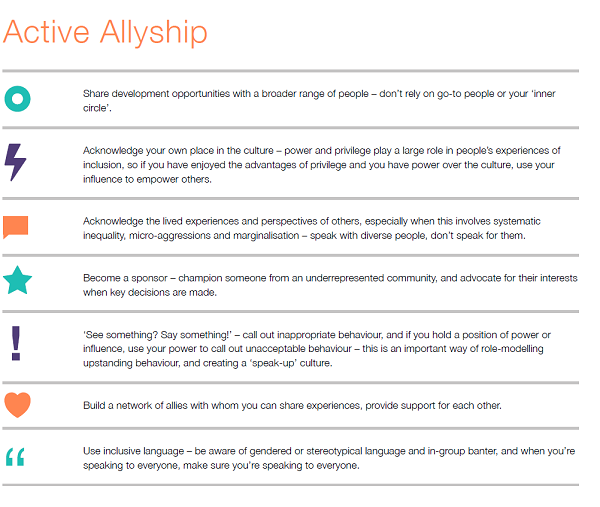

Our third annual survey also looks at the 2021 Dive In Festival theme of ‘Active Allyship and Empowerment’ and the important role we all have to play in turning our good intentions into impactful actions. This includes a practical checklist on ways we can each become an “Active Ally”.

We thank Liberty Specialty Markets, ANZIIF and everyone who completed the survey for their help to keep a spotlight on diversity and inclusion in the Australian insurance industry.

You can download a PDF of the full report here.

Informed Insurance

The home of fresh thinking about key insurance topics by subject matter experts from around the world.

Thought leadership

We curate our thought leadership around the insurance topics that matter most.

Predictions

We anticipate issues and opportunities for clients and share our future-focused insights in this annual report.

Themes

Our themes highlight key issues for the insurance sector, from class actions to technology.